Page 48 - Jamaica Post Office Guide 1938

P. 48

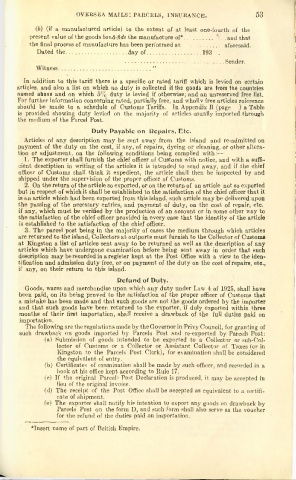

OVERSEA M AILS: PARCELS, INSURANCE. 5 3

(b) (if a manufactured article) to the extent of at least one-fourth of the

present value of the goods bond-fide the manufacture of*...................\ . and that

the final process of manufacture has been perfoimed at ....................... aforesaid.

Dated the.....................................day of..................................193 .

......................................... ................Sender.

Witness.........................................................”

In addition to this tariff there is a specific or rated tariff which is levied on certain

articles, and also a list on which no duty is collected if the goods are from the countries

named above and on which 5% duty is levied if otherwise; and an unreserved free list.

For further information concerning rated, partially free, and whollv free articles reference

should be made to a schedule of Customs Tariffs. In Appendix B (page ) a Table

is provided showing duty levied on the majority of articles usually imported through

the medium of the Parcel Post.

Duty Payable on Repairs, Etc.

Articles of any description may be sent away from the island and re-admitted on

payment of the duty on the cost, if any, of repairs, dyeing or cleaning, or other altera

tion or adjustment, on the following conditions being complied with:—

1. The exporter shall furnish the chief officer of Customs with notice, and with a suffi

cient description in writing of the articles it is intended to send away, and if the chief

officer of Customs shall think it expedient, the article shall then be inspected by and

shipped under the supervision of the proper officer of Customs.

2. On the return of the article so exported, or on the return of an article not so exported

but in respect of which it shall be established to the satisfaction of the chief officer that it

is an article which had been exported from this island, such article may be delivered upon

the passing of the necessary entries, and payment of duty, on the cost of repair, etc.

if any, which must be verified by the production of an account or in some other way to

the satisfaction of the chief officer provided in every case that the identity of the article

is established to the satisfaction of the chief officer.

3. The parcel post being in the majority of cases the medium through which articles

are returned to the island, Collectors at outports must furnish to the Collector of Customs

at Kingston a list of articles sent away to be returned as well as the description of any

articles which have undergone examination before being sent away in order that such

description may be recorded in a register kept at the Post Office with a view to the iden

tification and admission duty free, or on payment of the duty on the cost of repairs, etc.,

if any, on their return to this island.

Refund of Duty.

Goods, wares and merchandise upon which any duty under Law 4 of 1925, shall have

been paid, on its being proved to the satisfaction of the proper officer of Customs that

a mistake has been made and that such goods are not the goods ordered by the importer

and that such goods have been returned to the exporter, if duly exported within three

months of their first importation, shall receive a drawback of the full duties paid on

importation.

The following are the regulations made by the Governor in Privy Council, for granting of

such drawback on goods imported by Parcels Post and re-exported by Parcels Post:

(a) Submission of goods intended to be exported to a Collector or sub-Col-

lector of Customs or a Collector or Assistant Collector of Taxes (or in

Kingston to the Parcels Post Clerk), for examination shall be considered

the equivalent of entry.

(b) Certificates of examination shall be made by such officer, and recorded in a

book at his office kept according to Rule 17.

(c) If the original Parcels Post Declaration is produced, it may be accepted in

lieu of the original invoice.

(d) The receipt of the Post Office shall be accepted as equivalent to a certifi

cate of shipment.

(e) The exporter shall notify his intention to export any goods on drawback by

Parcels Post on the form D, and such form shall also serve as the voucher

for the refund of the duties paid on importation.

*Insert name of part of British Empire.